The National Housing Bank is tightening oversight of housing finance companies for breaching loan-to-value (LTV) norms on high-value home loans, two people aware of the development told ET. Supervisory inspections by the mortgage regulator found cases where loans above ₹s75 lakh were sanctioned at up to 90% LTV, in violation of the 75% cap.

The National Housing Bank (NHB) has directed individual lenders to reclassify such advances as non-home loans (NHL).

"The regulator has taken cognisance of a few mortgage lenders disbursing higher amounts on loans for high-value residential apartments," said an official aware of the NHB cautions. "The NHB has sent communications to these companies to stop such practices and classify them as non-home loans."

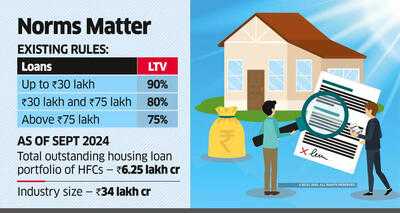

As per existing rules, loans of up to ₹30 lakh can have an LTV of up to 90%, those between ₹30 lakh and ₹75 lakh up to 80%, and loans above ₹75 lakh up to 75%. The scrutiny is also influencing market transactions, with HFCs purchasing loan portfolios from peers now insisting on explicit disclosures of whether the underlying assets are classified as home loans or non-home loans before adding them to their own books. "Earlier, while buying loan pools, HFCs weren't seeking LTV disclosures. But after the regulatory crackdown, they are asking for explicit home loan and non-home loan classifications in the books," said another official.

Both the Reserve Bank of India (RBI) and NHB have been cracking down on lenders flouting LTV norms. Regulators have observed that during periods of stress or economic downturns, borrowers with LTV ratios above 80% face significantly higher stress and are more prone to default.

The RBI, in December last year, had cautioned lenders against excessive exposure to all types of top-up loans (including home top-up loans), which are additional credit facilities extended to customers against their existing mortgages.

While many lenders perceive these loans as low-risk, they are often sanctioned with minimal due diligence, liberal underwriting, and weak adherence to prudential norms on loan-to-value ratios, risk weights, and end-use verification, the central bank had noted.

The banking regulator had warned that such practices could create systemic risks, particularly if the value of the underlying collateral turns volatile or faces a cyclical downturn. At the end of September 2024, HFCs had a total outstanding housing loan portfolio of ₹6.25 lakh crore, compared with the overall industry size of nearly ₹34 lakh crore, NHB data showed.

The National Housing Bank (NHB) has directed individual lenders to reclassify such advances as non-home loans (NHL).

"The regulator has taken cognisance of a few mortgage lenders disbursing higher amounts on loans for high-value residential apartments," said an official aware of the NHB cautions. "The NHB has sent communications to these companies to stop such practices and classify them as non-home loans."

As per existing rules, loans of up to ₹30 lakh can have an LTV of up to 90%, those between ₹30 lakh and ₹75 lakh up to 80%, and loans above ₹75 lakh up to 75%. The scrutiny is also influencing market transactions, with HFCs purchasing loan portfolios from peers now insisting on explicit disclosures of whether the underlying assets are classified as home loans or non-home loans before adding them to their own books. "Earlier, while buying loan pools, HFCs weren't seeking LTV disclosures. But after the regulatory crackdown, they are asking for explicit home loan and non-home loan classifications in the books," said another official.

Both the Reserve Bank of India (RBI) and NHB have been cracking down on lenders flouting LTV norms. Regulators have observed that during periods of stress or economic downturns, borrowers with LTV ratios above 80% face significantly higher stress and are more prone to default.

The RBI, in December last year, had cautioned lenders against excessive exposure to all types of top-up loans (including home top-up loans), which are additional credit facilities extended to customers against their existing mortgages.

While many lenders perceive these loans as low-risk, they are often sanctioned with minimal due diligence, liberal underwriting, and weak adherence to prudential norms on loan-to-value ratios, risk weights, and end-use verification, the central bank had noted.

The banking regulator had warned that such practices could create systemic risks, particularly if the value of the underlying collateral turns volatile or faces a cyclical downturn. At the end of September 2024, HFCs had a total outstanding housing loan portfolio of ₹6.25 lakh crore, compared with the overall industry size of nearly ₹34 lakh crore, NHB data showed.

You may also like

Kerala minister Cherian backs CPI-M's Govindan in 'leaked letter' controversy

Shankar Mahadevan, sons Siddharth and Shivam's 'Jai Shree Ganesha' brings alive festive spirit ahead of Ganeshotsav

Yosemite National Park: Ranger fired for hanging transgender pride flag on El Capitan; justice department eyes charges

Love was not enough. Bollywood actress put a condition for marrying Harbhajan Singh. How Yuvraj Singh helped the lovebirds

Mbappe's penalty gives Real Madrid winning start to LaLiga campaign