Is Dream11’s fantasy platform hitting a wall? That’s the indication from the company’s move into WinZO and MPL (M-League) territory with the launch of the Dream Play app.

Launched in May 2025, Dream Play brings games such as carrom, pool and potentially others such as archery, ludo and more that have become monetisable, as evidenced by WinZO and M-League. Both these major rivals — along with others — have become household names in the casual gaming space, but so is Dream 11.

So this new entry is once again heating up the Indian gaming sector. Could there be a spring in the offing for funding in gaming startups? Let’s find out.

We’ll look at how Dream11 has been compelled to break away from its core focus thus far, and whether this has anything to do with the company’s adjustments in light of the potential GST demands from real money gaming companies which is expected to severely hit Dream11.

But first, a look at the top stories from our newsroom this week:

- Builder.ai’s House Of Cards: Once an AI unicorn, Builder.ai is on the verge of dissolution amid allegations of faking its AI tech and revenue inflation to the tune of $300 Mn. Here’s how the fall happened and the lessons from the collapse of Builder.ai

- The Ride-Hailing U-Turn: Platforms like Rapido and Namma Yatri have popularised zero-commission, subscription-based models, forcing Ola and Uber to adopt similar approaches amid growing driver unrest. What does this mean for the ride-hailing industry?

- BigBasket’s Trump Cards: The INR 4,000 Cr revenue from private labels for BigBasket far surpasses anything that Zepto has generated through Relish and Daily Good, for instance, and is quickly becoming the Tata-owned platform’s massive moat

It’s been a busy 2025 for Dream11 which has launched several new products in the past few months and made key changes. And sandwiched between these critical developments was the peak fantasy gaming season of the IPL.

The Dream Play launch comes a few months after Dream11’s parent company redomiciled to India. The real money gaming major said the reverse flip was critical for the company to “achieve cost savings from more focused operational efforts, lead to consolidation of the group and elimination of inter-company transactions”.

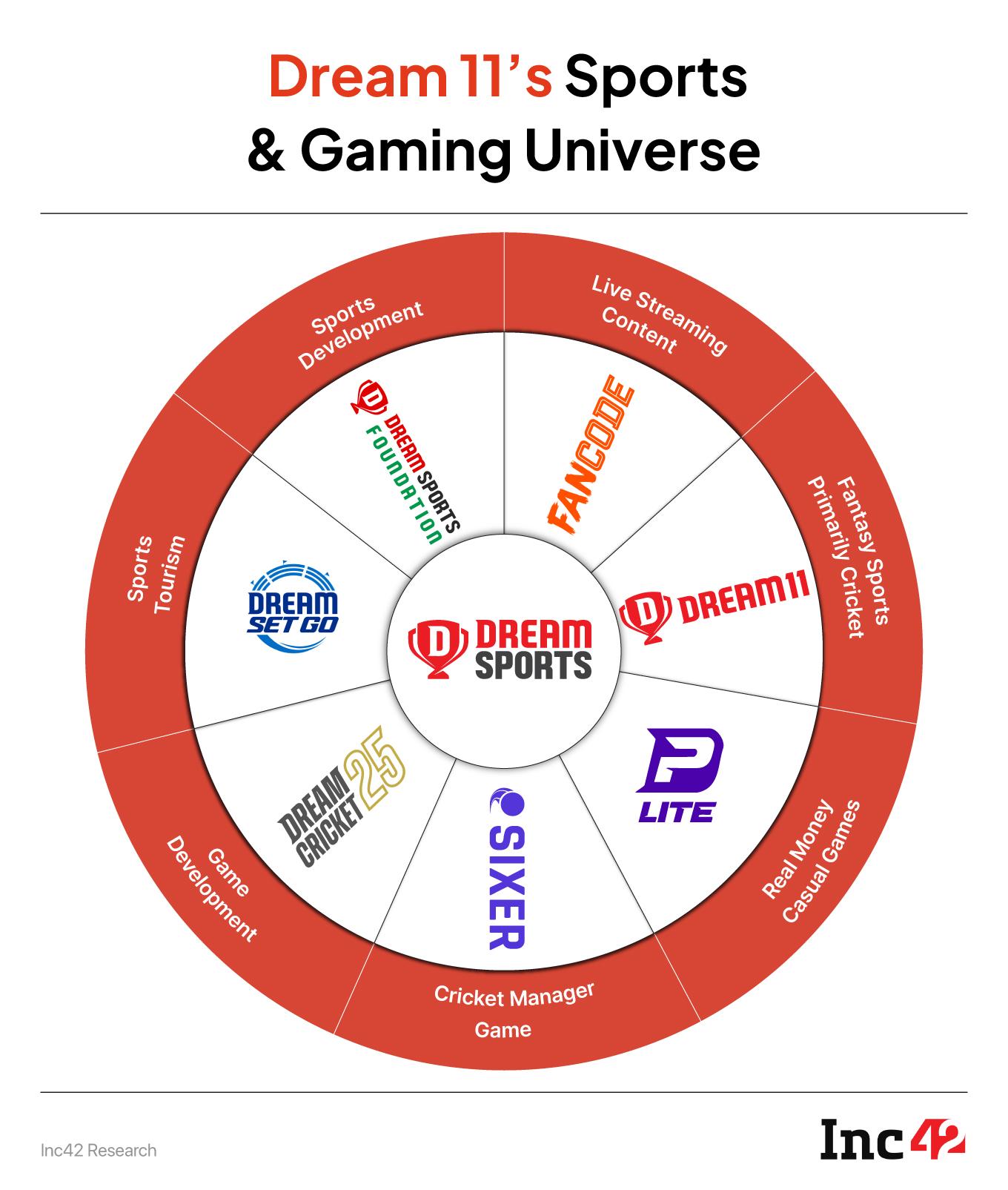

Dream Sports, the parent company, has thus far primarily catered to cricket fans with its sports tourism, fantasy gaming, sports streaming, and other platforms, and the launch of Dream Play is the first real deviation from this formula.

Even when it developed its own video game, Dream Sports stuck to cricket, and the brand’s identity is intrinsically linked to cricket. Dream11 is after all the shirt sponsor of the Indian cricket team and hundreds of millions of Indians are aware of the name.

This reach will be critical for Dream Play too. Dream11 would be hoping that years of investment in acquiring users for its fantasy gaming platform can now be leveraged for other areas.

For instance, users need to either create or login with their “Dream Sports” wallet to download and play the games. This indicates that Dream11 is going for a multi-app strategy by leveraging its existing user base.

Even without a lot of promotion for the new app, the app has already been downloaded by over a lakh users on Google Play Store. Dream11’s popularity would have pushed the app through the Google Play advertising channels to these first wave of users.

And next, Dream11’s strategy of cross-promoting Dream Play will be put to the test. One does wonder whether this launch will in some way mitigate the potential tax damages for Dream Sports due to the GST adjustment for real money gaming.

Dream Play Vs GST Demands?As we have explained through our coverage over the past two years, real money gaming companies are grappling with potential tax demands of thousands of crores, with Dream Sports expected by industry insiders to be among the most impacted companies.

As per unconfirmed reports, Dream Sports faces a GST demand of more than INR 28,000 Cr ($3 Bn+), after it had reported a 32% YoY increase in net profit to INR 188 Cr and a 66% YoY jump in operating revenue for to INR 6,385 Cr in FY23. But, the GST demands are likely to apply for previous financial years as well as for FY24 and FY25.

Industry insiders estimate that Dream Sports will see 60% of its profit base erode, based on estimated revenue figures. It must be noted that Dream Sports hasn’t yet filed its financial statements for FY24 or FY25, even though its primary competition has for FY24. So, the tax estimates might end up being lower or higher than the stated figures.

As per a report released by Deloitte India and the Federation of Indian Fantasy Sports in February 2025, the industry is expected to see a degrowth of about 10% in its top line in FY25.

“The sector is bracing for impact as a result of the change in GST laws. Not only is the sector expected to de-grow by 10% in FY25, but the industry is also expected to post a reduced CAGR of 7% for FY24 to FY29, compared to the earlier forecasted CAGR of 30% for FY22 to FY27. This degrowth is driven by a whopping 50% hit on the fantasy sports companies’ margins as a result of companies absorbing the impact of increased GST,” the report read.

In January 2025, the Supreme Court put atemporary halt on the GST proceedings against 49 real money gaming companies, staying retrospective demand notices, but the tax authorities are unlikely to back off without a fight given the amount at stake.

Competing In A New ArenaDream Play’s two major competitors in the casual gaming space reached major milestones in the previous fiscal year. WinZO, for instance, reached INR 1,055 Cr mark in revenue for FY24 and its profit stood at INR 315 Cr as against INR 125 Cr in FY23.

M-League, the parent of gaming unicorn Mobile Premier League (MPL), claimed its operating revenue jumped 22% to $127.9 Mn (INR 1,080 Cr) in FY24.

Both companies have preferred a diversified approach to gaming whereas Dream11 had made its mark in fantasy gaming. Now, Dream11 has to jump into another battle with WinZO and M-League.

The potential tax demands had forced Dream Sports to shut down its corporate venture investment arm Dream Capital, which had earlier been allocated a corpus of $250 Mn.

Speaking to Inc42 in May, WinZO founder Paavan Nanda revealed that around100 paying users join WinZO daily and over 50% of users are retained month on month.

Besides Dream Play, Dream11 also launched another real money fantasy app Dream Picks earlier this year. This is similar to Dream11 and lets users make fantasy teams for smaller sports tournaments. This app has seen over 5 Lakh downloads till now.

There are other apps that align with the company’s focus on cricket and fantasy gaming as well, but these are not major by any degree. One wonders whether Dream Play is a mere experiment or a real product push for the Harsh Jain-led company.

Why Dream11 Has Gone CasualOne factor for the launch could be that Dream11’s fantasy app is going through a slowdown. After all, apps in this category do not spend marketing money when there are no high value international tournaments featuring India or the IPL around the corner.

This forces fantasy sports into a seasonal window, and this is not a great thing from a growth point of view, as per industry experts. The shut down of apps in the fantasy gaming space in 2023 and 2024 has also been a factor in Dream Sport’s diversification.

The new Dream Play app allows Dream11 to be relevant throughout the year — the brand name stays in the limelight from January to December and is not dependent on cricket tournaments.

However, Dream Play will need to splurge marketing dollars and kick off a brand new promotional campaign that does not depend on Dream11’s existing marketing machine. Communication has to differ from the main Dream11 app and marketing strategy has to be differentiated as well.

That’s because fantasy gaming is one thing, and India’s love for cricket is largely responsible for the rise of these platforms. Dream11 cashed in, and it essentially has all the top cricketers on its side when it comes to endorsements. Replicating this for something that’s not cricket will not be easy and is by no means guaranteed.

There’s also a risk that any potential success for Dream Play will bring more and more focus on casual gaming as a sector; it would not be surprising if WinZO and M-League also see a boost as that’s the typical result of increased app marketing spending. App stores will cross promote similar apps when users first install Dream Play.

Will this spark a new spring for VC funding in online gaming startups after the lull of the past two years? It’s too soon to tell. That depends on how serious Dream Sports is on its new bet, or whether this is just another casual game.

Sunday Roundup: Startup Funding, Deals & More

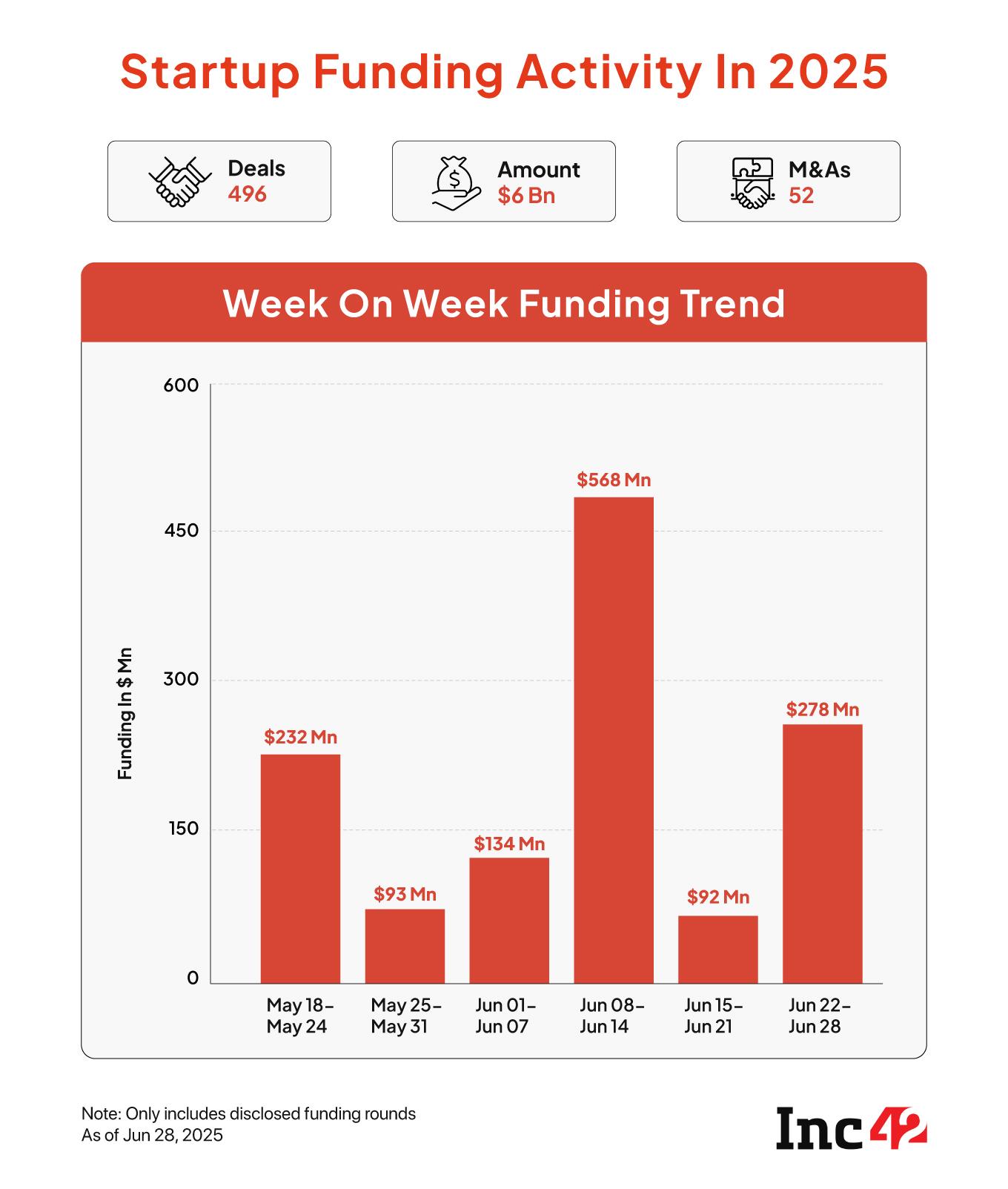

- Funding Rises: Between June 23 and 28, startups raised $278.3 Mn across 22 deals, nearly 3X of the $91.5 Mn raised in the preceding week, with the total tally for the first half of the year reaching $6 Bn

- JFS Gets Brokerage Licence: Jio BlackRock, the joint venture between Jio Financial Services (JFS) and BlackRock, has received SEBI’s approval to kick off operations as a brokerage firm adding to the company’s array of financial services

- Quick Commerce Boom: Swiggy cofounder and CEO Sriharsha Majety expects the Indian quick commerce market to become a $30 Bn to $40 Bn opportunity in the next three to five years

- Manipal’s Stake In Aakash:The CCI has approved Manipal Group’s proposal to acquire a stake in Aakash Educational Services from the coaching chain’s founder JC Chaudhry

- BluSmart Breaks Down: Months after it suspended cab booking services, troubled EV ride-hailing startup BluSmart’s app has stopped working with customers unable to open any section in the app

The post Dream11 Takes Casual Gaming Break From Fantasy Blues appeared first on Inc42 Media.

You may also like

Kardashians use Bezos' wedding to 'self promote' as expert explains 'selfie obsessed' sisters

India taking steps to ensure Bangladesh can't reroute jute exports via 3rd countries

Brits urged to place 1 thing in garden this summer to 'naturally' attract birds

Potatoes are the 'best' with 1 simple air-fryer method

Adorable dad trend takes over TikTok showing day in the life of '50/50' parenting