An increase in FII inflows and better-than-expected Q4 earnings season took the Indian equities market higher this week amid the ongoing tensions between India and Pakistan following the Pahalgam terrorist attack.

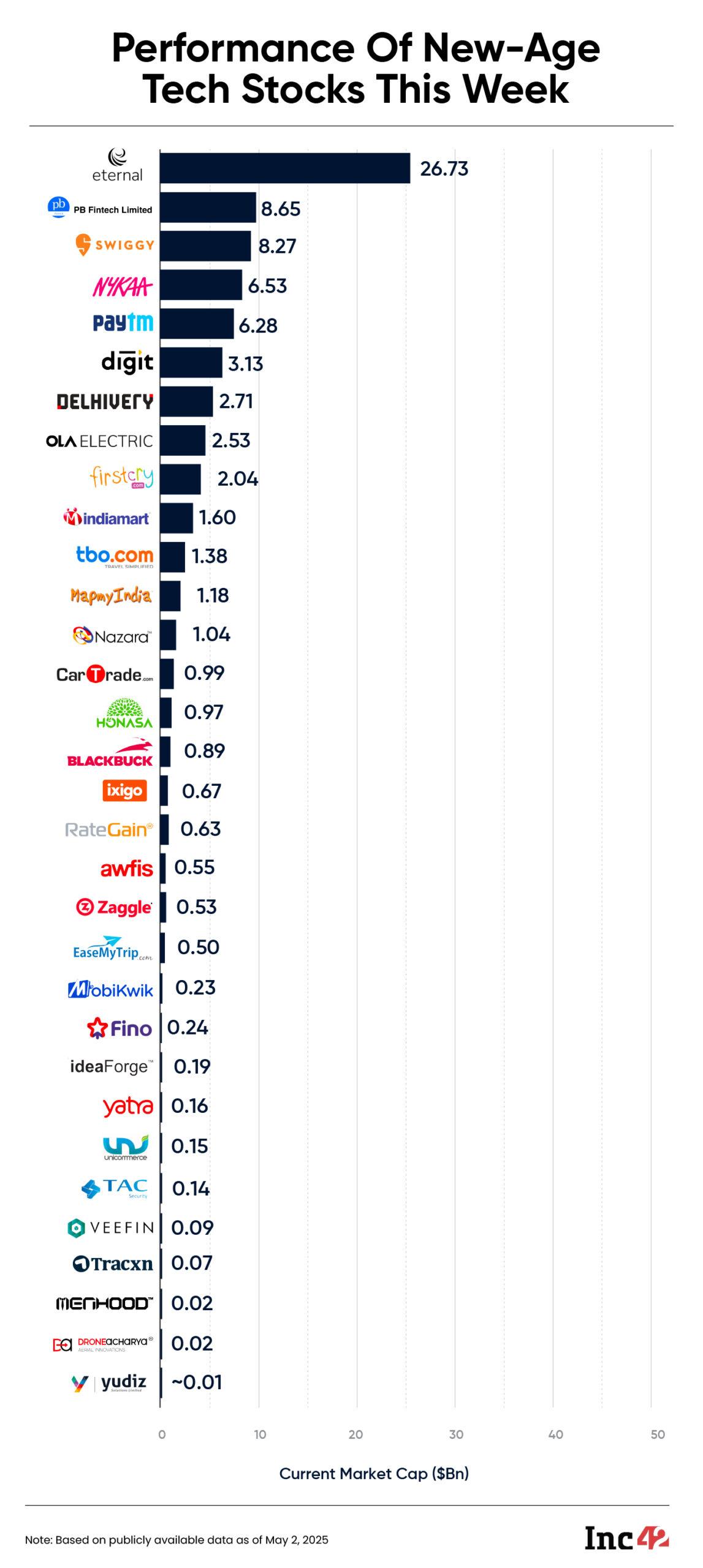

However, it turned out to be a mixed week for new-age tech stocks. Seventeen out of the 32 new-age tech stocks under Inc42’s coverage gained in a range of 0.13% to over 10% this week.

After seeing an extended bearish sentiment for the past few months, BSE SME-listed fintech SaaS company Veefin Solutions emerged as the biggest gainer this week on the back of its strong financial performance in H2 FY25.

The company’s shares gained 10.05% to end the week at INR 329.75. It reported a , while the top line zoomed 274% to INR 59.5 Cr.

NSE Emerge-listed cybersecurity company TAC Infosec was another SME firm which saw big gains this week. On Monday (April 28), it reported a in H2 FY25. Operating revenue zoomed 174% to INR 18.1 Cr during the period. Following this, the company’s shares ended the week 4.28% higher at INR 1,160.

Eternal, IndiaMART InterMESH and Fino Payments Bank also declared their financial performances for Q4 FY25 during the week, leading to a strong investor interest in their shares. Delhivery, BlackBuck, EaseMyTrip, Nazara Technologies, Nykaa and Honasa Consumer were among the other gainers this week.

Meanwhile, 15 new-age tech stocks ended the week in the red, falling in a range of 1.57% to over 6%.

MobiKwik bled the most this week, with its shares slumping 6.05% to end at INR 248.45. The stock has declined about 44% from its listing price of INR 442.25. The bearish investor sentiment came despite the company’s subsidiary Zaakpay ePayment Services Pvt Ltd receiving the .

MobiKwik bled the most this week, with its shares slumping 6.05% to end at INR 248.45. The stock has declined about 44% from its listing price of INR 442.25. The bearish investor sentiment came despite the company’s subsidiary Zaakpay ePayment Services Pvt Ltd receiving the .

Its competitor Paytm also saw a weak investor sentiment, with its shares dipping 4.93% to end at INR 248.45. Earlier in the week, Paytm said that its gaming subsidiary, First Games, received a from the Directorate General of GST Intelligence (DGGI).

Meanwhile, EV major Ola Electric’s shares dipped 2.57% to end at INR 48.59. Its rival Ather Energy’s IPO closed this week with a . The public issue closed with an oversubscription of 1.43X. The muted response came amid mixed brokerage calls on the IPO.

Overall, the cumulative market cap of the 32 new-age tech stocks declined to $79.08 Bn at the end of this week from $78.37 Bn a week ago.

Indices Gain Despite India-Pakistan Tensions

Indices Gain Despite India-Pakistan Tensions The threat of a military conflict between India and Pakistan continued this week. However, the equities market remained resilient, with Sensex gaining 1.6% to end at 80,501.99. Nifty 50 zoomed 1.3% to end at 24,039.35.

Notably, the stock exchanges were closed on Thursday (May 1) on account of Maharashtra Day.

As per analysts, the optimism about India and the US reaching consensus on a bilateral trade agreement was the main reason behind the rally this week.

Besides, upbeat corporate earnings added to the bullishness. For instance, Reliance Industries Ltd reported a consolidated net profit of INR 22,400 Cr in Q4, higher than the INR 18,500 Cr consensus estimate of analysts polled by Bloomberg.

A weakening US dollar and persistent inflationary concerns in the US prompted FIIs to continue their buying spree in the Indian equities market. The FIIs were net buyers in April, buying shares worth INR 3,243 Cr. Foreign investors remained consistent buyers in the cash market in the last 12 days, buying equities worth INR 40,145 Cr.

Commenting on the Indian equity market, Vinod Nair, head of research at Geojit Investments, said, “Domestic markets are expected to remain cautious in the near term amid ongoing geopolitical tensions, although a sharp correction is not currently anticipated. Globally, easing trade tensions between the US and China, coupled with a weakening US dollar, are seen as medium-term positives for emerging markets such as India. However, the recent decline in Q1 US GDP growth adds a layer of uncertainty.”

Now, let’s take a look at the performance of Eternal and Go Digit this week.

Go Digit Falls Despite Jump In Q4 ProfitDespite reporting a sharp uptick in its profit, Go Digit’s shares dipped 4.02% to end the week at INR 286.55. The insurtech company reported a , up 119% from the INR 52.7 Cr in the year-ago quarter.

Meanwhile, gross written premium (GWP) went up 10.3% YoY to INR 2,576.4 Cr in the March quarter. The company’s total income stood at INR 2,855.2 Cr during the quarter under review, up 6% from INR 2,692.5 Cr in Q4 FY24.

However, brokerage Emkay reiterated its ‘sell’ rating on Go Digit, along with a price target (PT) of INR 250.

Calling the company’s Q4 FY25 results a mixed bag, Emkay noted challenges in its journey to deliver “superior growth with improving profitability”. It listed reasons like no motor third-party tariff hike in FY26, lower support from past reserves, less openings for the company to negotiate pricing with corporates as the key reasons behind its bearish outlook.

Blinkit Takes A Toll On Eternal, AgainZomato’s parent Eternal reported a lacklustre financial performance in Q4 FY25 due to a slowdown in food delivery business and widening losses of Blinkit amid intensifying competition and the expansion spree of the quick commerce vertical.

The Deepinder Goyal-led company’s . However, operating revenue zoomed 64% to INR 5,833 Cr from INR 3,562 Cr in the year-ago quarter.

Despite the mixed performance, Eternal’s shares zoomed 2.58% to end the week at INR 234.25. Brokerage JM Financial remained positive on the company, reiterating its ‘Buy’ rating with a price target of INR 280.

In a note, the brokerage firm said that it expects Blinkit to materially slowdown expansion of warehousing capacity and dark stores from Q2 FY26 onwards, which in turn could lead to meaningful operating leverage benefit and likely peaking of its losses in Q1 FY26.

“Further upside to margins can come, as and when the business starts to move to an inventory-led model. Zomato’s (food delivery) GOV growth in Q4 FY25 was also steady at 16% YoY (ahead of JMFe of 15% YoY), despite adverse impact of leap year in the base quarter and management decision to delist ~19k restaurants from the platform on account of quality issues. Eternal remains our top pick in the hyperlocal delivery space,” the brokerage noted.

The post appeared first on .

You may also like

'India needs partners, not preachers': Jaishankar once again tears into EU

Ukraine war LIVE: Kyiv on fire after Russia unleashes night of terror

Warren Buffett shares views on tariffs, AI, dollar depreciation, and Berkshire Hathaway's cash reserves at annual meeting

Coordination needed between Grand Alliance parties at district level, says Congress MLA ahead of Bihar elections

Sudhakaran confident party will not remove him from KPCC president Post