Shadowfax is the latest startup to make a beeline for the exchanges. The Flipkart-backed logistics giant filed its updated draft red herring prospectus (DRHP) with SEBI last week for INR 2,000 Cr public issue, split evenly between a fresh issue and an offer-for-sale (OFS) component.

The OFS component will see early backers like Flipkart, Eight Roads Ventures, TGP and Nokia Growth Partners offload their stakes in the logistics unicorn.

Among the selling shareholders, Flipkart will offload shares worth up to INR 237 Cr. While Eight Roads Ventures will sell shares worth up to INR 197 Cr, TPG Inc will offload shares worth up to INR 150 Cr through its NewQuest Asia Fund IV.

Nokia Growth Partners plans to sell shares worth up to INR 100.8 Cr, while investors and Snapdeal cofounders Kunal Bahl and Rohit Bansal will offload shares worth INR 14 Cr each via the OFS.

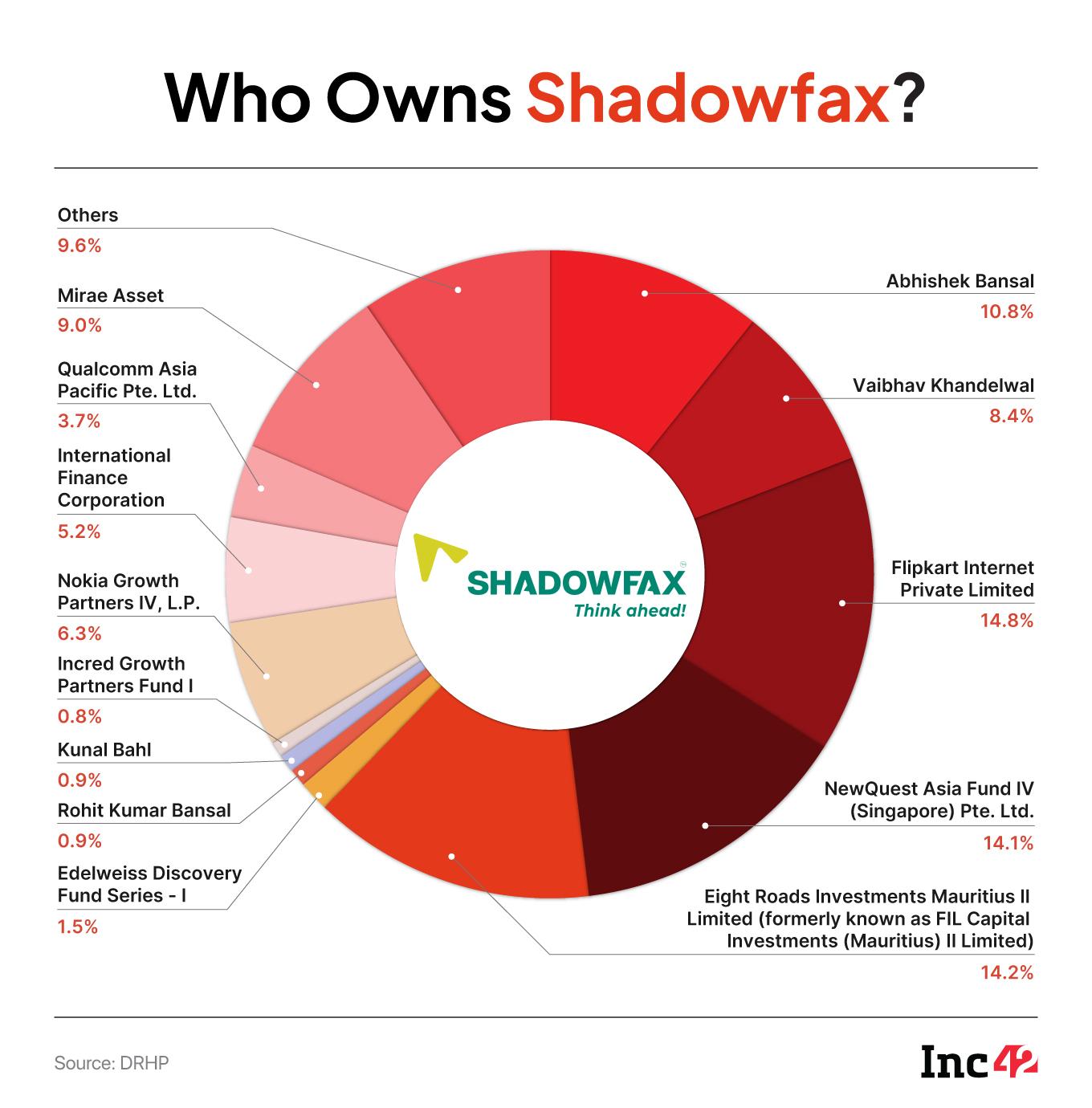

As Shadowfax readies for its stock market debut, it’s worth asking — who truly owns the delivery giant?

Among institutional shareholders, Flipkart Internet Private Limited is the largest with 14.84% equity. Playing second fiddle is Eight Roads Investments (14.16%), followed closely by TPG’s NewQuest Asia Fund IV (Singapore) Pte. Ltd. with 14.09% stake.

Other key investors include Mirae Asset (8.97%), Nokia Growth Partners IV, LP (6.31%), and International Finance Corporation (IFC) with 5.24% stake. Qualcomm Asia Pacific Pte. Ltd. owns 3.66%, while Edelweiss Discovery Fund Series – I also holds 1.53%.

Among angel investors, Snapdeal cofounders Rohit Bansal and Kunal Bahl each own 0.88%, while Incred Growth Partners Fund I holds 0.76%. The remaining 9.55% equity is distributed among other shareholders.

According to the UDRHP, Shadowfax’s cofounders and promoters Abhishek Bansal and Vaibhav Khandelwal cumulatively hold 19.13%, or 85.89 Cr equity shares. Bansal owns 10.76%, while Khandelwal holds 8.37%. Neither of them will offload any stake via the IPO.

Founded in 2015, Shadowfax offers last-mile delivery services to ecommerce platforms and D2C brands. It also provides solutions such as reverse logistics, parcel exchange, and quick delivery options. The company counts Mamaearth, Nykaa, Flipkart, and Meesho among its key clients.

As of September 30, Shadowfax’s nationwide logistics network comprised 4,299 touchpoints, spanning first-mile, last-mile, and sortation centers. Its serviceable pin codes nearly doubled from 7,955 in 2023 to 14,758 as of June 2025.

On the financial front, the company charted a turnaround and posted a profit of INR 6 Cr FY25 against a loss of INR 12 Cr inFY24. On similar lines, operating revenue rose 32% year-on-year (YoY) to INR 2,485 Cr.

Marking further improvements, its net profit jumped more than 2X YoY to INR 21 Cr in H1 FY26 from INR 9.8 Cr in the year-ago period. The company’s top line for the period under review zoomed 68% to INR 1,805.6 Cr during the period under review from INR 1,072.1 Cr in H1 FY25.

Express delivery services contributed around 60-70% of Shadowfax’s operating revenue in FY25, while hyperlocal delivery (quick commerce) brought in about 20% of the top line. The company views the latter as a major growth driver going forward.

However, the company’s revenue stream isn’t well-diversified and faces client concentration risk. Nearly half of Shadowfax’s FY25 revenue came from its top five clients, with Meesho and Flipkart alone accounting for around 74.5% of total operating revenue.

In terms of other risks, Shadowfax faces stiff competition from incumbents such as Delhivery and Blue Dart, regulatory and labour-related challenges linked to its gig workforce, and potential margin pressure as it rapidly scales its hyperlocal operations.

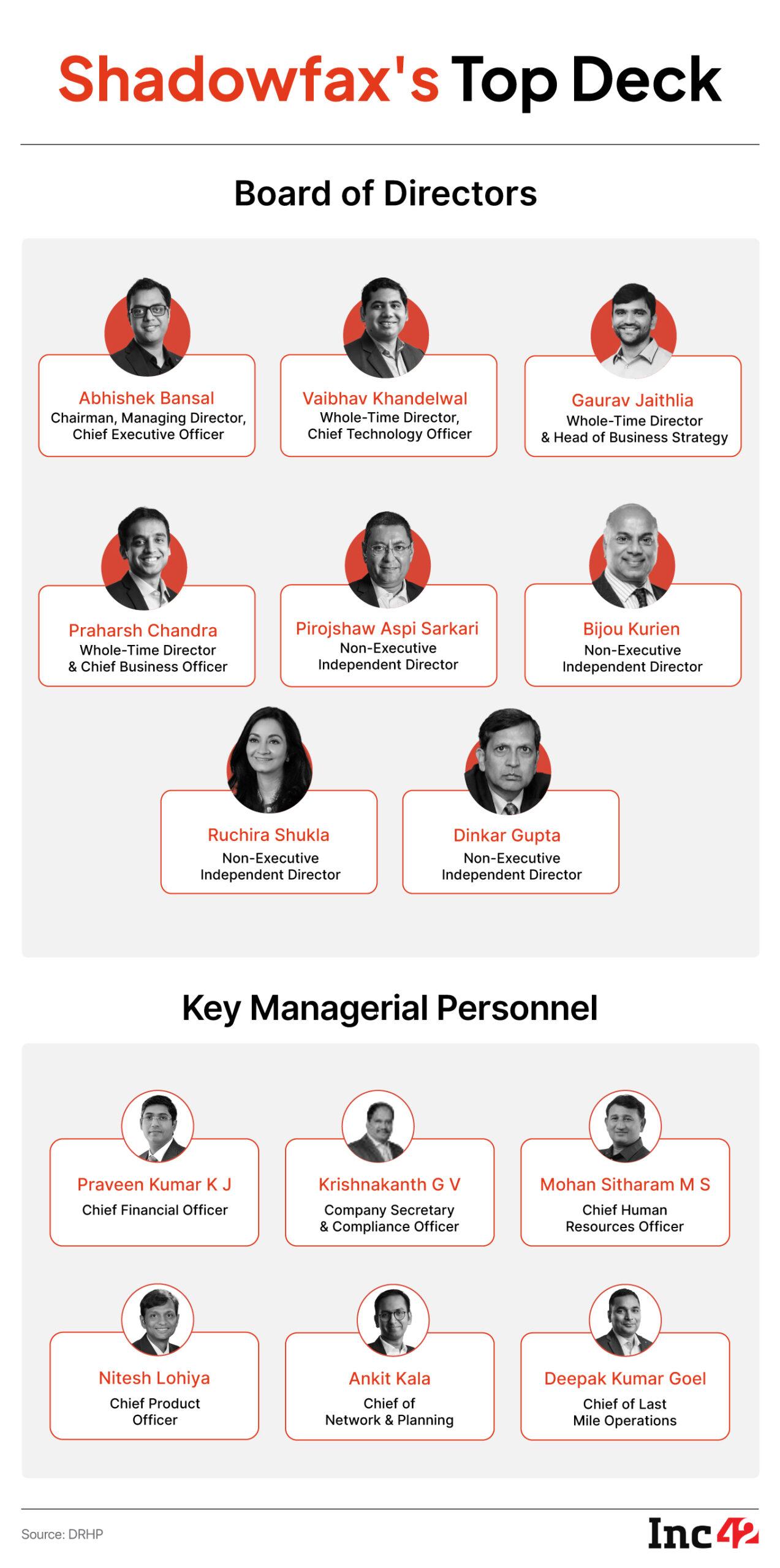

With that said, let’s take a detailed look at the top executives at the helm of affairs at Shadowfax and its board:

Who Sits On Shadowfax’s Board?Abhishek Bansal

Cofounder Bansal is the chairman, managing director and chief executive officer of Shadowfax. He is responsible for overall organisational growth and profitability. The IIT-Delhi alum had a two year stint with consulting firm Hay Group before founding Shadowfax in 2015.

Bansal has a professional experience of more than a decade in the logistics industry. In the financial year 2025, Bansal received a total remuneration of INR 1.05 Cr.

Vaibhav Khandelwal

Cofounder Khandelwal serves as the chief technology officer, whole-time director, and one of the promoters of Shadowfax. In his current role, he oversees the development of innovation and future-ready products.

He has been associated with Shadowfax since its inception and was earlier with Way2Wealth Securities. In FY25, Khandelwal drew a salary of INR 1.05 Cr.

Gaurav Jaithliya

Cofounder Jaithliya is a whole-time director and the head of business strategy at Shadowfax, responsible for growth of key clients and oversees the inorganic expansion efforts. He cofounded the company and has close to a decade of experience in the logistics sector.

In FY25, Jaithliya received a total remuneration of INR 11.5 Cr.

Praharsh Chandra

Cofounder Chandra is a whole-time director and the chief business officer of Shadowfax, responsible for revenue growth and overseeing the company’s financials.

He, too, joined the company in 2015 and has over 12 years of experience in consulting and business management. In FY25, Chandra received a total salary of INR 8.2 Cr.

Pirojshaw Aspi Sarkari

Sarkari is a non-executive independent director on Shadowfax’s board and has been associated with the company since February 2025.

A chartered accountant, Sarkari had a near 10 year long stint with Mahindra Logistics as its CEO. As of now, he also serves as an independent director for Billion Mobility, Jeena & Company, Logical.ai. Besides, he has been associated as an angel investor with Inflection Point Ventures (IPV). He drew a salary of INR 3 Lakh in FY25.

Bijou Kurien

Kurien is a non-executive independent director of Shadowfax and has been associated with the company since 2025. Prior to joining Shadowfax, Kurien was associated with Hindustan Unilever, Titan Company and Reliance Industries.

He has over 40 years of experience in the management, retail and lifestyle sectors. Kurein received a remuneration of INR 4 Lakh in FY25.

Ruchira Shukla

Shukla is a non-executive independent director of Shadowfax, and has been associated with the logistics unicorn since 2025.

Prior to joining Shadowfax, she was associated with World Bank Group’s IFC. She has over 12 years of experience in private equity investing, strategy consulting and investment banking sectors. Shukla received a remuneration of INR 3 Lakh inFY25.

Dinkar Gupta

Gupta is a non-executive independent director of Shadowfax. He is a retired Indian Police Service (IPS) officer and served as the Director General of Police, Punjab. He retired as Director General of the National Investigation Agency (NIA) in 2024.

Praveen Kumar KJ

Kumar is the chief financial officer (CFO) of Shadowfax, responsible for financial management and governance. He joined the company in 2019 and was earlier associated with XSEED Education, OnMobile Global Ltd, HP, among others.

He has over 20 years of experience in the fields of finance and strategy. During FY25, he received a remuneration of INR 1.7 Cr from Shadowfax.

Krishnakanth GV

Krishnakanth is the company secretary and compliance officer of Shadowfax, responsible for secretarial compliance matters. He joined Shadowfax in 2024 and was earlier associated with Subex, Tejas Networks and GMR Infrastructure.

Krishnakanth has over 18 years of experience in the secretarial, governance and compliance sectors. During FY25, he received a remuneration of INR 21 Lakh from Shadowfax.

Mohan Sitharam MS

Sitharam MS serves as the company’s chief human resources officer, responsible for talent management and people strategy. He joined Shadowfax in 2022 and was earlier associated with Subex, LTIMindtree and Shipara Technologies.

He brings in over 21 years of experience in human resource management to Shadowfax’s C-Suite. In FY25, he received a remuneration of INR 1.5 Cr.

Nitesh Lohiya

Lohiya is the chief product officer of Shadowfax, responsible for ensuring efficient operations and launching new products.

Prior to joining Shadowfax, he was associated with Flipkart, Microsoft, SAP Labs India and Tata Consultancy Services. He has over 21 years of experience in technology and product management.

In FY25, he received a remuneration of INR 2.04 Cr from Shadowfax.

Ankit Kala

Kala is the chief of network and planning, responsible for overseeing middle-mile operations, using data and analytics to improve operational efficiency and building financial models forecasts.

He joined Shadowfax in 2020 and has over thirteen years of experience in consulting, strategic planning and operations. In FY25, he received a remuneration of INR 1.5 Cr from Shadowfax.

Deepak Kumar Goel

Goel is the chief of last mile operations of Shadowfax, responsible for managing the complete scope of last mile operations.

He joined the company in 2021 and was earlier associated with Procter & Gamble Home Products. He has over 16 years of experience in manufacturing and supply chain areas.

In FY25, he received a remuneration of INR 1.6 Cr from Shadowfax.

The post Shadowfax DRHP: Shareholding Structure & Key Executives appeared first on Inc42 Media.

You may also like

The pretty little town with the 'UK's best fish and chips shop'

US plans to deny residency visas to Indians with chronic diseases

Aryna Sabalenka chokes back tears in emotional scenes after losing WTA Finals final

“Thank you for choosing us”- Gabrielle Union reflects on her surrogacy journey in an emotional birthday post for daughter Kaavia

Ghislaine Maxwell makes 'Alice in Wonderland' admission in new prison